IN THE KNOW

COMMON SCAMS TARGETING OLDER ADULTS & HOW TO AVOID THEM | PART 2

JULY 30, 2024 | FRAUD PREVENTION

A while ago, we examined the top 5 common scams targeting older adults. This month, we will explore the remaining 5 elder scams and how to avoid them. If you missed part 1, you can find it HERE.

, in 2023, over 101,000 Americans aged 60 and above fell victim to fraud, with losses exceeding $3.4 billion. This represents an 11% increase in losses from 2022.

Scammers craft their schemes to exploit vulnerabilities and manipulate emotions. By staying informed about common scams, you can arm yourself with the knowledge to recognize and avoid these deceptive tactics. Awareness is a powerful tool in the fight against fraud, helping you to identify red flags before falling prey to them.

6. FUNERAL SCAMS

In funeral scams, fraudsters use obituaries to identify vulnerable targets. The fraudster may attend the funeral or call the grieving family members and claim that the deceased owed them a debt. Fraudsters can also use personal information included in obituaries to steal the deceased’s identity and open new accounts in their name.

How to protect yourself:

- Do not include personal information such as complete addresses, full birthdates, and phone numbers in obituaries.

- If you are acting as an executor for an estate, alert credit bureaus and the deceased’s financial institutions and utility providers of their death as soon as possible.

7. MEDICARE SCAMS

In these schemes, fraudsters pose as Medicare representatives or healthcare professionals and ask older adults for their personal, financial, and health information. Once they’ve obtained this information, they can use it to open accounts in the victim’s name or bill Medicare for fake services and pocket the money.

How to protect yourself:

- Protect your Medicare number as you would your credit card number or online banking credentials.

- Review your Medicare statements regularly and report suspicious activity to 1-800-MEDICARE.

8. HOME REPAIR SCAMS

Fraudsters identify homes owned by older adults and knock on doors or make calls to offer quotes for home repairs and upgrades. If the homeowner agrees to the work, the fraudster then asks for an initial deposit or full payment. Once they have received the money, the fraudster either disappears or provides sloppy, subpar work.

How to protect yourself:

- Do not pay in advance for services.

- If you are considering hiring someone to do work on your home, take the time to learn more about them or their company. Ask for references, read reviews, and look the company up with watchdog groups like the Better Business Bureau or your local consumer protection agency.

9. SWEEPSTAKES & LOTTERY SCAMS

Fraudsters will contact potential victims by phone, mail, email, or text and tell them they’ve won a lottery or sweepstakes. In order to claim the prize, the victim is told they must make an upfront payment to cover taxes or other fees. After they’ve made a payment, the prize money never shows up. Sometimes fraudsters will send victims fake checks to deposit and ask them to return a portion for taxes and fees before the check bounces and the funds are removed from the account.

How to protect yourself:

- Do not pay for prizes. Do not provide financial information like a bank account or credit card number to be entered into a prize giveaway or sweepstakes.

- Before accepting an unexpected prize or winnings, talk to a trusted friend or family member. They may be able to help identify the warning signs of a lottery scam.

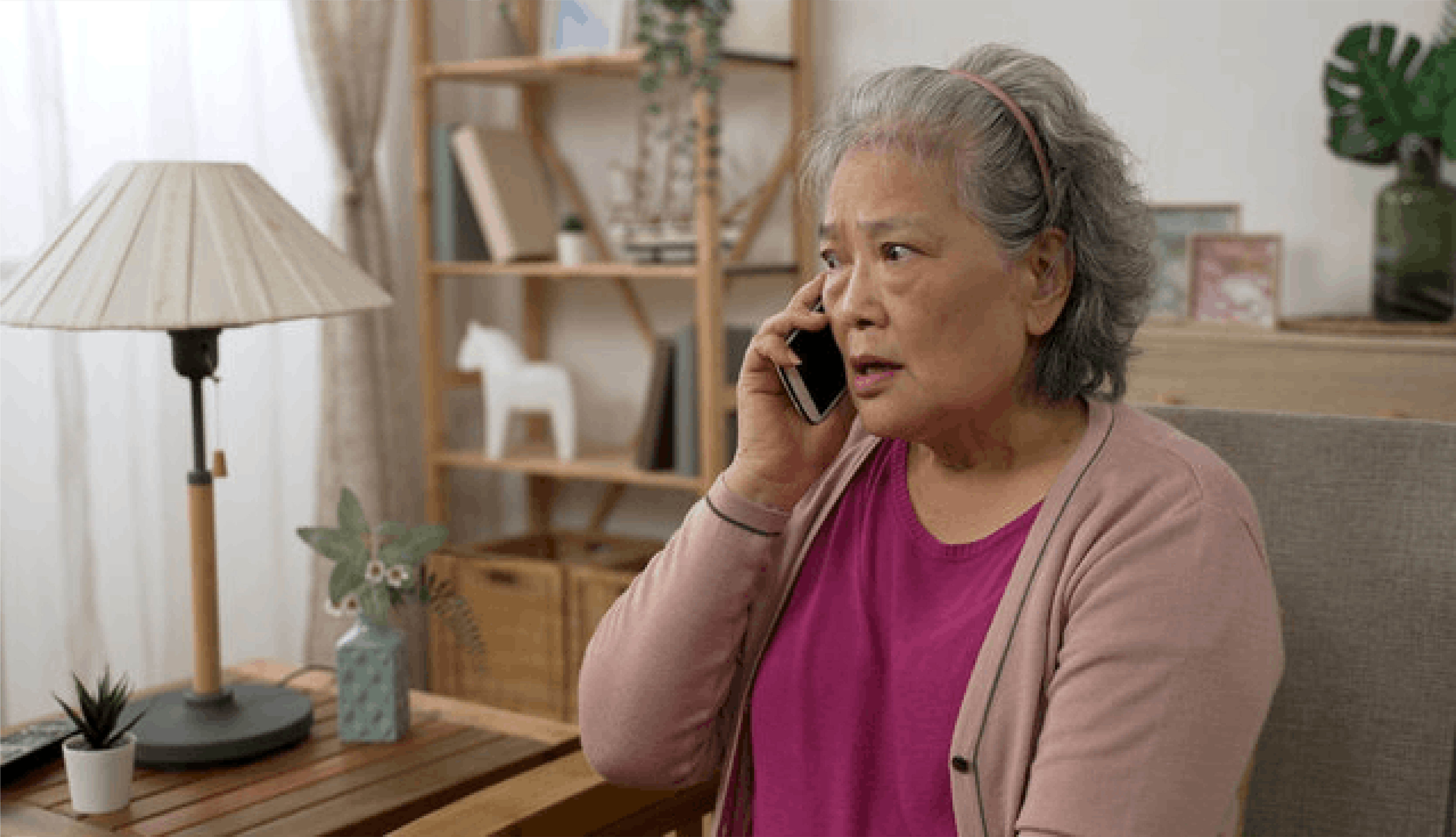

10. GRANDPARENT SCAMS

Grandparent scams occur when fraudsters call older adults and pose as a grandchild in distress or a police officer, doctor, or lawyer trying to help the grandchild. Fraudsters may scour social media for the names of grandchildren, or simply manipulate victims into revealing their grandchildren’s names. The fake grandchild then asks for money to solve an urgent financial problem such as overdue rent, hospital bills, car repairs, or jail bonds. The fake grandchild may ask you not to tell anyone, saying they are embarrassed or don’t want to get in trouble. Fraudsters often ask for money to be sent using methods that are difficult to track such as gift cards or wire transfers.

How to protect yourself:

- Resist the urge to act immediately.

- Call a phone number you know belongs to your grandchild or their parent and verify the story.