Adams Bank & Trust Business Credit Cardholders: Your credit card & login experience are being upgraded! While customers receive their new cards and transition to the new login system, both the legacy and new business credit card login options will be available. Once you have received and activated your new card, you can begin using the new login option ( you will enroll with your new card details).

IN THE KNOW

AG UPDATE

NOVEMBER 12, 2024 | AG BANKING

On November 7th the Federal Reserve decreased the over night rate by 25bps lowering it to about 4.75%. This was much inline with market expectations. The most recent PCE release shows that inflation is continuing to trend towards the Fed’s 2% target. Recent jobs reports have been weaker than expected and prior jobs reports have been consistently revised downward. Regardless of this, the unemployment rate has remained steady at around 4.1%. Focus now moves to the December Fed meeting where the market is pricing in a 75% chance of another 25 bps decrease.

While short-term rates have declined along with the Fed, the long end of the yield-curve has continued to increase. The 10-YR yield has increased from its low in mid-September of 3.623% to 4.32%. The peak rate in this time was 4.435%, which is just under the 3-year high of 4.9% set in October of 2023.

With the US election all but over and clear winners set to take over in 2025, many have moved towards focusing on the federal debt level. Neither party ran a campaign that focused on the federal deficit. Economist have began to worry about the possibilities of a bond vigilantes taking over the bond market. If enough bond vigilantes sell bonds, it is possible that lawmakers will be forced to limit tax cuts and cut spending.

With Election Day behind us, what will another Trump Administration mean for Agriculture and the commodity markets? A win by either candidate would have generated a new list of unknowns. In addition, the Republicans are poised to possibly gain control of both chambers of Congress. As the country now moves forward to a second term for President Trump, the following are just some of the issues which will be affecting agriculture:

- • Will there be new commodity tariffs or a second “trade war” with China?

- • What changes may be made to tax policy? Business regulations?

- • A major part of the Trump platform centered around the direction of domestic energy policy – will this be a net positive for grain and cattle markets?

- • How might immigration reform affect the availability and cost of labor for farm producers and processors?

- • Will the US Federal Reserve be less aggressive with interest rate cuts if fiscal policies under Trump turn out to be more stimulative for business?

Initial reactions in the commodity markets the day after Election Day were mixed. However there remains much to be seen in the coming weeks before Trump takes office.

In the very short term, a new USDA report awaits to be unveiled on November 8th. With much of the US fall harvest complete, this report is expected to refine the existing 2024 crop estimates. Analyst expectations are for the trend of a growing crop size to continue. However, it is also expected that the increasing demand for grains could offset the increases in crop size, resulting in lower expected carryover grain inventories.

As of November 7th:

- • Corn DEC $4.25

- Bull: Cheap US corn is stimulating demand. Middle-East hostilities create uncertainty in energy markets.

- Bear: Stronger dollar as of late is negative to exports.

- • Soybeans NOV $10.00

- Bull: Marketing year is off to a good start on exports.

- Bear: : What would Trump Administration do on tariffs and how would that impact Chinese purchases of US beans? Strong pace of S. American bean plantings.

- • KC Wheat DEC $5.68

- Bull: Black Sea region weather and export logistics have not been friendly to wheat production and exports, but may be price friendly.

- Bear: : Recent moisture in western wheat production areas.

- • Livestock

- Feeders NOV $248

- Live Cattle DEC $186

- Lean hogs DEC $81

Here are some key developments that have or will have big impact on our weather:

- • Heavy snow has fallen in the central and southern Rocky Mountains providing moisture to some drought stricken areas. The storm will move northeastward and continue to provide moisture into the Great Lakes Region.

- • Temperatures in the corn belt have fallen to normal fall temperatures. Additionally, some areas received rainfall boosting moisture in the topsoil.

- • Brazil continues to have favorable summer for their emerging crop.

Source: “AgWest Commodities - Weather.” Goagwest.com, goagwest.com/pages/weather-new.php. Accessed 4 Nov. 2024.

- • Noninsured Crop Disaster Assistance Program (NAP) application deadline Nov. 15.

- • Acreage certification for fall-planted crops due Nov 15.

- • Beginning Farmer/Rancher resources are available at: .

Source: U.S. Department of Agriculture,

Look at all these fall / winter learning and networking opportunities!

- • NBA Agriculture and Beyond Workshop - KEARNEY, NE December 10th

- • COLORADO AG SHOW - GREELEY, CO January 28th - 30th

- • 33RD ANNUAL BUFFALO BILL FARM & RANCH SHOW - NORTH PLATTE, NE February 7th - 8th

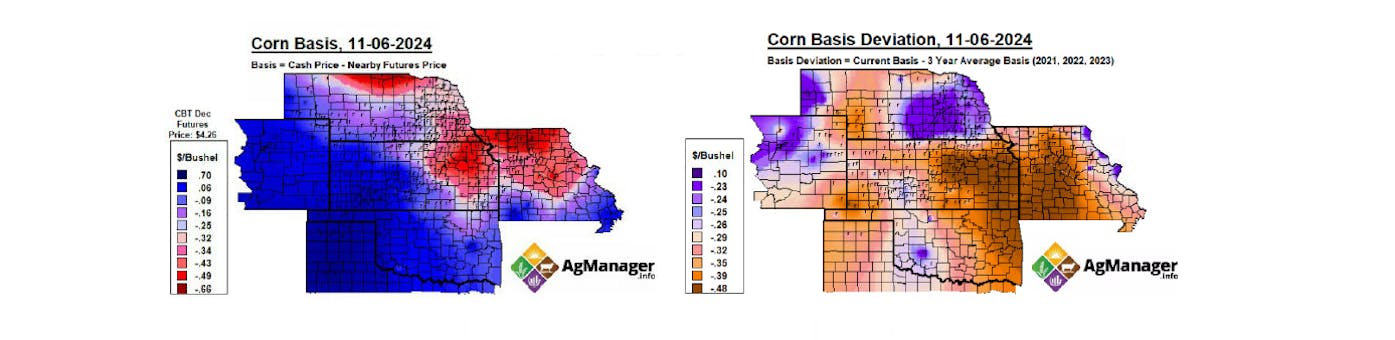

Tis the season for corn harvest so I thought I’d share some interesting illustrations of basis for our region. The illustration on the left show basis as of November 6th and the one on the right provides a three-year average (2021,2022,2023). At a time with low commodity prices (everywhere) and low yields (in some places), the basis provides one positive. For information on other crops, go to .