Adams Bank & Trust Business Credit Cardholders: Your credit card & login experience are being upgraded! While customers receive their new cards and transition to the new login system, both the legacy and new business credit card login options will be available. Once you have received and activated your new card, you can begin using the new login option ( you will enroll with your new card details).

IN THE KNOW

AG UPDATE

OCTOBER 15, 2024 | AG BANKING

It appears the the Fed may well achieve the “soft landing” that everyone has hoped for. In late July, Fed focus shifted to a worsening jobs market as inflation was steadily declining. This resulted in a 50 bps decrease in the Fed funds rate.

September CPI released on October 10 was below the prior release but all measures were 0.1% above expectations. The latest jobs report showed very strong gains in job numbers, a reduction in unemployment rate, and an upwards revision in the August report of new jobs. With inflation now cooling more slowly than expected and jobs rebounding, the case for holding rates steady is getting stronger.

The next Fed meeting is November 7, just two days after voting concludes. This decision will no doubt be politicized by both parties and media pundits. The Fed’s preferred gauge for inflation is the PCE which is scheduled to be released on October 31.

After several months of bearish crop reports, a reverse in the corn and soybean markets has taken place over the last few weeks. Although anecdotal harvest reports continue to support the fact that we are currently harvesting potentially record large crops, it appears that at least short term lows may have been recently established. The main drivers of the turnaround in prices have been the unwinding of record short commodity fund positions, as well dry conditions in September which may have taken the top-end off of some of the record crop yields. In addition, the recent softening of monetary policy by the US Federal Reserve Bank has turned the currency markets friendly. Further anticipation of lower interest rates is bringing down the strength of the US dollar and making already cheap US corn and beans even cheaper in the export marketplace.

Attention now turns to the USDA Supply & Demand report on October 11. At this time, analyst estimates for the report are as follows:

As of October 9:

- • Corn DEC $4.21

- Bull: Demand base is building. Will warm and dry September result in lower than anticipated final yields?

- Bear: A record yield is forecasted and carryover inventory from 2023-24 remains high.

- • Soybeans NOV $10.20

- Bull: First quarter of marketing year is off to a good start on exports. Lower interest rates should be bearish for US dollar and supportive for exports.

- Bear: Record crop is on the way in the U.S. Uncertainty about the US presidential election – would Trump 2.0 lead to additional tariffs and US-China trade war?

- • KC Wheat DEC $6.09

- Bull: Ukraine/Russia war continues to provide uncertainties on exports from that region.

- Bear: Seasonal harvest pressure, world-wide production remains adequate.

- • Livestock

- Feeders OCT$249

- Live Cattle OCT $188

- Lean hogs OCT $84

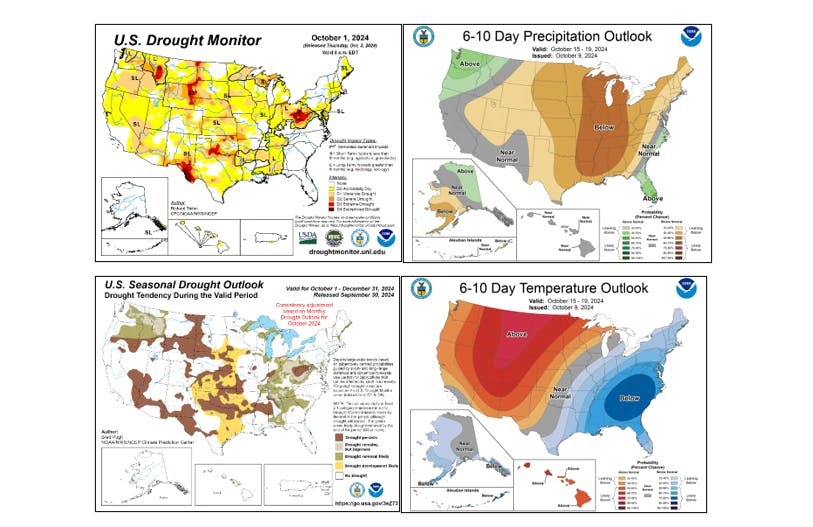

Here are some key developments that have or will have big impact on our weather:

- • While effects from Hurricane Helene still linger, Hurricane Milton made landfall and in some locations that were already hit heavily by Helene.

- • Drought expands in the central US. Forecasts show some relief could come in November.

- • Brazil’s monsoon season has started with moisture in their 10-day forecast. Normal planting conditions are expected.

Source: “AgWest Commodities - Weather.” Goagwest.com, goagwest.com/pages/weather-new.php. Accessed 10 Oct. 2024.

- • Noninsured Crop Disaster Assistance Program (NAP) application deadline Nov. 15.

- • Acreage certification for fall-planted crops due Nov 15.

- • Beginning Farmer/Rancher resources are available at nebraskabeginningfarmer.org.

Source: U.S. Department of Agriculture,

Look forward to some big fall / winter learning and networking opportunities.

- •COLORADO AG SHOW - GREELEY COLORADO January 28th - 30th

- •33RD ANNUAL BUFFALO BILL FARM & RANCH SHOW - NORTH PLATTE February 7th - 8th

I’ve highlighted the following charts, from the article listed above, given how well they convey land price trends. The graph on the left shows trend data from regions represented by Federal Reserves. Our district, Kansas City, shows a slightly less than 5% year-over-year increase in dryland prices. Still an increase but far less than the nearly 25% increase in 2022. The chart on the right drills down to most current percent change by state with Nebraska at 3% and Kansas at 2%. With farm net income decreasing and low commodity prices, one would assume price increases will continue to soften and perhaps even decrease (a bit anyway).

As a side note, there is more pressure for state and federal governments to address the inherent risk of allowing foreign entities or foreign-backed US entities to own and control ag land. Legislation that lessons or prohibits this situation would decrease the pool of land buyers which, in turn, would become one factor contributing to lower land prices.